Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Economic forecasting has never been easy, and it becomes even more challenging in the face of unprecedented events like COVID-19 lockdowns and extraordinary levels of fiscal and monetary intervention. This was followed by a rapid cycle of interest rate hikes, adding further complexity. Look no further than the fact that for three consecutive years (2022, 2023, and 2024) economic forecasts at large significantly underestimated mortgage rates.

Recently, however, forecasters have fared better. Among the 17 mortgage rate forecasts rounded up by ResiClub heading into 2025, the average prediction was that 30-year fixed mortgage rates would average 6.33% in Q4 2025. At the time we published that roundup, the average 30-year fixed mortgage rate was sitting at 7.03%. What happened? The 30-year fixed mortgage rate ended up averaging 6.23% in Q4 2025.

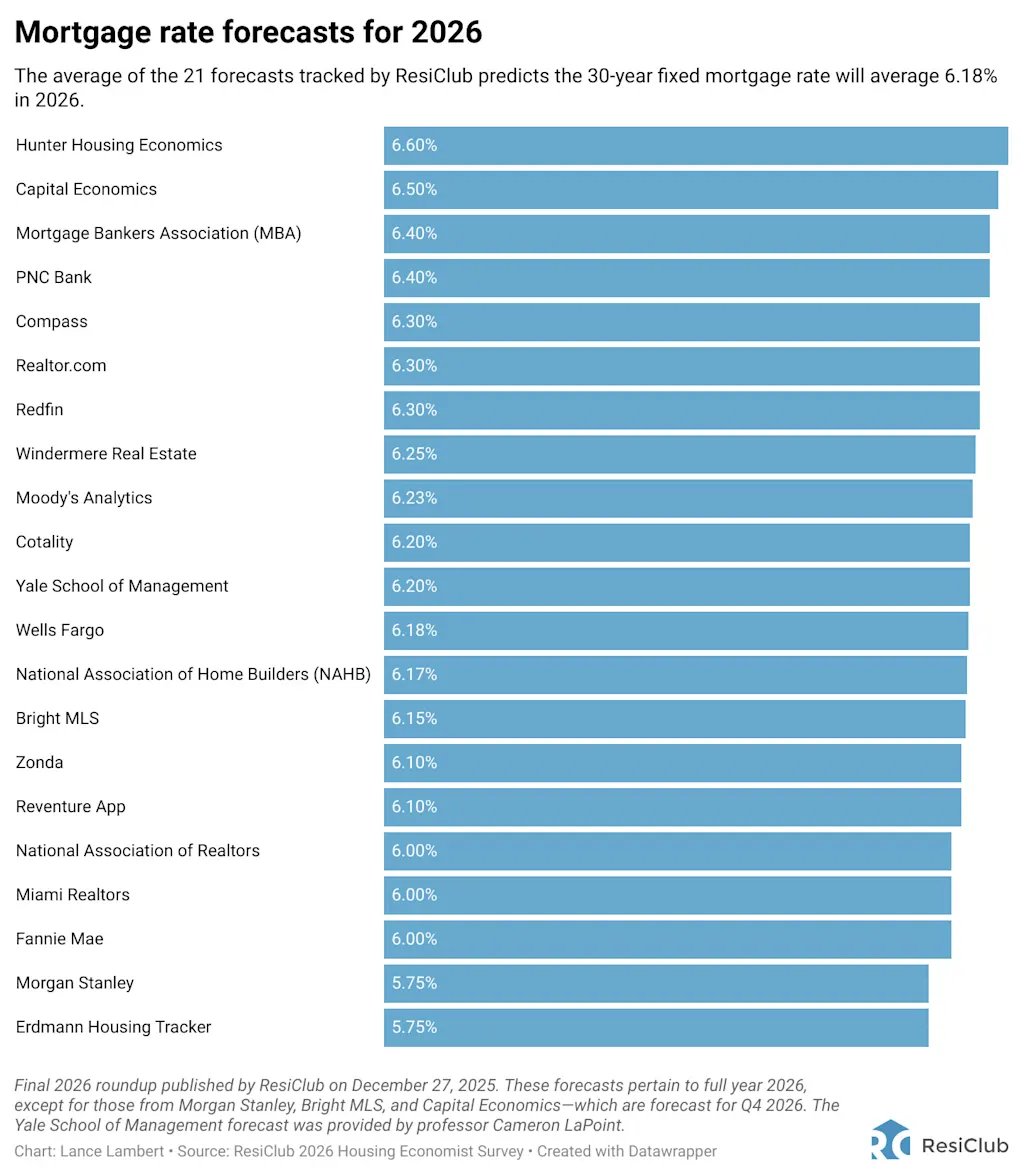

For our 2026 mortgage rate roundup, ResiClub collected 21 mortgage rate forecasts. Some were publicly available, though most were gathered through the ResiClub 2026 Housing Economist Survey, which we fielded in December 2025. Rather than asking only about Q4, we asked respondents to provide their forecast for the full 2026 calendar year.

While ResiClub approaches rate forecasts with a healthy dose of skepticism—for example, if the labor market were to unexpectedly weaken, rates could drop more than anticipated—there is still value in understanding where economic models predict mortgage rates will head.

Below are 21 mortgage rate forecasts (sorted from highest to lowest).

Hunter Housing Economics: The research firm predicts that the 30-year fixed mortgage rate will average 6.6% in 2026. Housing economist Brad Hunter told ResiClub: “The impending change in leadership at the Fed could lead to easier monetary policy, which could lead to lower mortgage rates, but this is not clear. The extent of the decline and mortgage rates will depend upon factors like bond market inflation expectations and the budget deficit as well as the rate of GDP growth.”

Capital Economics: Economists at the independent economic research business based in London forecasts that the 30-year fixed U.S. mortgage rate will average 6.5% in Q4 2026.

Mortgage Bankers Association: The latest forecast published by the trade group has the 30-year fixed mortgage averaging 6.4% in 2026.

PNC Bank: Economists at the American bank forecasts that the 30-year fixed mortgage rate will average 6.4% in 2026 and 6.4% in 2027.

Compass: Mike Simonsen, the chief economist of Compass, forecasts an average 30-year fixed mortgage rate of 6.30% in 2026.

Realtor.com: Economists at the real estate listing site forecast that the 30-year fixed mortgage rate will average 6.30% in 2026, including 6.3% in Q4, writing: “The mortgage rate lock-in effect—caused by market rates that are well above the rates on existing mortgages—has left many homeowners with a strong reason to stay put. In fact, recent data showed that 4 out of every 5 homeowners with a mortgage has a rate below 6%. The share has waned gradually, a trend that will continue in 2026. As a result, turnover will be limited with moves likely to be spurred by life necessities such as job or family changes.”

Redfin: Economists at the residential real estate brokerage are predicting an average 30-year fixed mortgage rate of 6.3% in 2026, writing: “A weaker labor market will lead the Fed to cut interest rates in 2026 and bring monetary policy to a more neutral place, which should keep mortgage rates in the low-6% range. But lingering inflation risk and the likelihood that we’ll avoid a recession will keep the Fed from cutting more than the markets have already priced in. That’s why rates may dip below 6% occasionally, but not for any meaningful period. The Fed will change leadership in 2026, but that is also unlikely to bring significantly lower mortgage rates, as long term rates–like mortgage rates–are set by bond markets.”

Windermere Real Estate: The economics team at Windermere Real Estate forecasts the 30-year fixed mortgage rate will average 6.25% in 2026.

Moody’s: The forecast by Moody’s chief economist Mark Zandi has the 30-year fixed mortgage rate averaging 6.23% in 2026—and 6.22% in Q4.

Cotality: Economists at the real estate analytics giant are predicting an average 30-year fixed mortgage rate of 6.2% in 2026. Selma Hepp, Cotality chief economist, tells ResiClub: “The 2026 outlook points toward a return to more typical market conditions, with mortgage rates expected to settle near 6%, home prices increasing gradually by about 2% to 4%, and improvements in both affordability and availability of homes for sale. Even so, continuing hurdles like higher non-mortgage expenses, including surging insurance costs and rising property tax bills, limited affordability, and uneven regional trends will keep bifurcating the market and impact decisions of both buyers and sellers.”

Yale School of Management: Finance professor Cameron LaPoint forecasts the 30-year fixed mortgage rate to average 6.2% in 2026—and 6.05% in Q4.

Wells Fargo: Analysts at the bank forecast 30-year fixed mortgage rate averages of 6.18% in 2026 (and 6.2% in Q4). Looking even further ahead, they’re forecasting a 6.25% average in 2027.

National Association of Home Builders: Robert Dietz, chief economist at NAHB, forecasts an average 30-year fixed mortgage rate of 6.17% in 2026.

Bright MLS: Economists at the firm expect the 30-year fixed mortgage rate to average 6.15% in Q4 2026. Bright MLS chief economist Lisa Sturtevant writes: “Lower rates will improve affordability and bring more buyers into the market in 2026. Mortgage rates began falling at the end of the third quarter of 2025. With additional Federal Reserve rate cuts planned for 2026, a response to weakening economic conditions, expect mortgage rates to fall from about 6.25% at the beginning of 2026 to 6.15% by the end of 2026.”

Zonda: Ali Wolf, chief economist at Zonda, forecasts the 30-year fixed mortgage rate to average 6.10% in 2026.

Reventure App: Founder Nick Gerli tells ResiClub he expects the 30-year fixed mortgage rate to average 6.1% in 2026.

National Association of Realtors: The economics team at the trade group forecasts the 30-year fixed mortgage rate to average 6% in 2026. NAR chief economist Lawrence Yun writes: “As we go into next year, the mortgage rate will be a little bit better. . . . It’s not going to be a big [mortgage rate] decline, but it will be a modest decline that will improve affordability.”

Miami Realtors: Economists at the group—which represents more than 60,000 real estate professionals and is the largest local Realtor association in the U.S.—forecast the 30-year fixed mortgage rate to average 6% in 2026, and 6.2% in Q4. Gay Cororaton, chief economist of Miami Realtors, tells ResiClub: “With the Fed carefully balancing to achieve its dual mandate, inflation is likely to adjust downward to 2% slowly while the unemployment rate will edge up lightly or remain stable as the Fed avoids a hard landing. The only way for inflation to adjust quickly is if unemployment rises sharply as well to effect a decline in real wages. Either the Fed [is] still caught between the devil and the deep blue sea, I expect mortgage rates to essentially just move sideways, so sales and prices will also post very modest single-digit increases. Affordability will slightly improve but I don’t see prices falling significantly despite the modest demand because sellers will also pull back to preserve their home equity gains. With home affordability still the biggest challenge for homebuyers, the upper price tier or the market will continue to be the most active segment.”

Fannie Mae: The latest forecast issued by Fannie Mae in December has the 30-year fixed mortgage rate averaging 6% in 2026 and 5.9% in 2027.

Morgan Stanley: Strategists at the investment bank forecast the average 30-year fixed mortgage rate will finish 2026 at 5.75%. In a report published on November 19, 2025, Morgan Stanley analysts write: “As we gaze into our proverbial crystal ball for the year ahead, we see affordability improving at the margins as mortgage rates dip below 6%. That should provide a modest boost to both existing and new home sales, though we think there is more upside in 2027 than 2026. . . . The modest rally in the primary rate we expect to 5.75% will likely bring some new borrowers into the money, but the impact would be marginal: Only about 6% of conventional borrowers would benefit from that 50bp decline. Beyond that, the next 100bp drop would only add another 8% of borrowers. Meaningful refinance incentives don’t emerge until rates fall below 4%, leaving the market in what we call a “refi wasteland” for much of 2026—though we’ll note that just because we’re in a refi wasteland doesn’t mean mortgages in-the-money won’t see valuation challenges driven by shorter lags and increasing originator efficiency.”

Erdmann Housing Tracker: Housing analyst Kevin Erdmann tells ResiClub he expects the 30-year fixed mortgage rate to average 5.75% in 2026—and finish 2026 at 5.22%.

Topline finding?

Among the 21 mortgage rate forecasts tracked by ResiClub, the average prediction is 6.18% for calendar year 2026. That’s on par with the current average 30-year fixed mortgage rate (6.09%).

Among the 21 mortgage rate forecasts for 2026 tracked by ResiClub, the highest is 6.6% (Hunter Housing Economics), while the lowest is 5.75% (Morgan Stanley and Erdmann Housing Tracker).

Over the past three years, turnover in the U.S. existing-home market has been constrained. Some of that reflects “pulled-forward” sales that occurred in 2020, 2021, or early 2022 rather than in 2023, 2024, or 2025.

But much of the slowdown stems from affordability and the lock-in effect created by the rate shock and sharply higher switching costs: Many homeowners who would like to sell and move are either unwilling to take on a much higher monthly payment or unable to qualify for one.

All else being equal, if mortgage rates were to fall more than expected, there would be slightly more turnover and sales in the existing home market.

Let’s say they’re wrong and mortgage rates fall more than expected. What happens?

- There’s a potential wildcard—an economic slowdown. If joblessness were to climb faster than anticipated or if the economy were to meaningfully deteriorate, that could put additional downward pressure on both Treasury yields and mortgage rates. In that scenario, mortgage rates could dip more than the baseline forecasts suggest.

- The “mortgage spread” represents the difference between the 10-year Treasury yield and the average 30-year fixed mortgage rate. This week, the spread stood at 207 basis points. If the spread—which widened when mortgage rates spiked in 2022—continues to compress/normalize toward its long-term average since 1972 (176 basis points), it could help push mortgage rates lower even if Treasury yields hold steady.

Housing stakeholders should keep in mind that a mortgage rate forecast is not a firm’s projection for the highest—or lowest—rate in the coming year. Rather, it reflects the average rate for the calendar year. And, of course, in any given year the average 30-year fixed mortgage rate can move well above and well below that annual average.

A recent ResiClub analysis of Freddie Mac’s weekly mortgage-rate dataset finds that since 1972, the average annual range in the 30-year fixed mortgage rate is 1.4 percentage points. If you move the goalpost to just this century—since 2001—the average annual range in the 30-year fixed mortgage rate is 1.08 percentage points. In 2025, the range was 0.87 point.

One last thought: Mortgage rate forecasts should always be taken with a grain of salt—at least to some degree. Predicting long-term yields depends on accurately anticipating inflation, Federal Reserve policy, and the broader trajectory of the U.S. and global economies, all of which are notoriously hard to get right. Over just the past five years, forecasters have been caught off guard by a pandemic, a historic inflation spike, and one of the fastest rate-hiking cycles in modern history.

The lesson? Even the best models can’t account for every shock. Mortgage rate forecasts are useful guideposts—but not guarantees.