Key Takeaways

- Take-Two Interactive on Thursday delayed the launch of its next high-profile “GTA” game until November 2026.

- That news appears to have overshadowed some upbeat financial projections from the company, dragging on the stock today.

Some of the biggest video-game news of the season is about a game that isn’t even expected this year—though it was once.

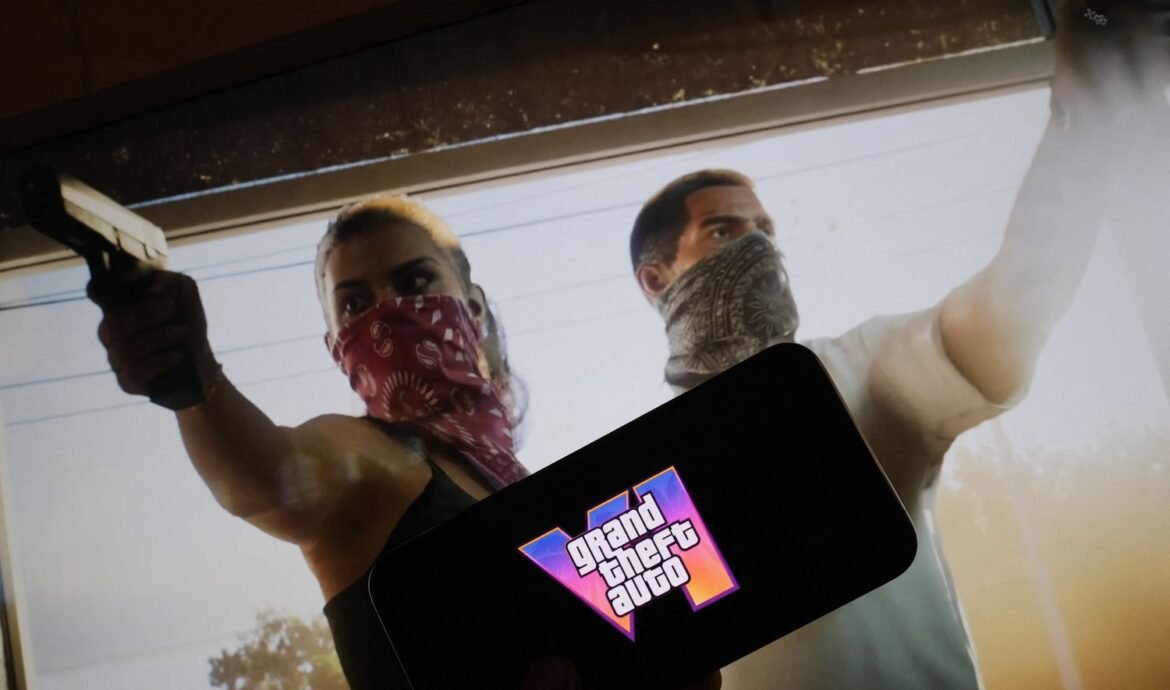

Shares of Take-Two Interactive (TTWO) on Friday fell 8%, putting it among the S&P 500’s bigger decliners, following last night’s news that the company will postpone the release of one of the industry’s highest-profile games—the sixth installment in the “Grand Theft Auto” series—until November 2026. The company earlier this year said it would push the game back from its original target date, in 2025, to next May.

Take-Two’s Rockstar Games division “will now release Grand Theft Auto VI on November 19, 2026,” Take-Two CEO Strauss Zelnick said in a statement, “and we remain both excited and confident they will deliver an unrivalled blockbuster entertainment experience.”

Why This Matters to Take-Two Investors

Investors tend to be more focused on what might come next than what just happened. That was clear from the reaction to news from Take-Two Interactive, which yesterday reported strong numbers for its latest completed quarter but added fresh uncertainty to its outlook for next year by delaying a highly anticipated game.

That news may have overshadowed an upbeat outlook for the fiscal year—set to end March 31—that included improved forecasts for revenue and net loss per share when compared with those offered earlier this year. Bookings for the most recently completed quarter also came in better than Take-Two had earlier indicated.

The company’s stock has risen more than 25% this year, and most analysts expect that to continue despite the latest disappointment. Visible Alpha recently tracked only “buy” ratings, and a mean price target above yesterday’s close.

“The headline from [the latest] results is undoubtedly the further delay of GTA VI,” Jefferies analysts wrote. “We have been here before, and expect any [near-term] weakness to get bought similar to past delays.”

UBS analysts figure that once the marketing machine for the game gets rolling, investors will feel more confident about the stock and business. “Good things come to those who wait,” they wrote.