The biggest drama in Hollywood in recent months hasn’t been on the silver screen but in the boardrooms of two of the most powerful companies in the industry.

In December, streaming giant Netflix announced its intention to acquire legendary Hollywood studio Warner Bros. after its planned separation from Discovery Global.

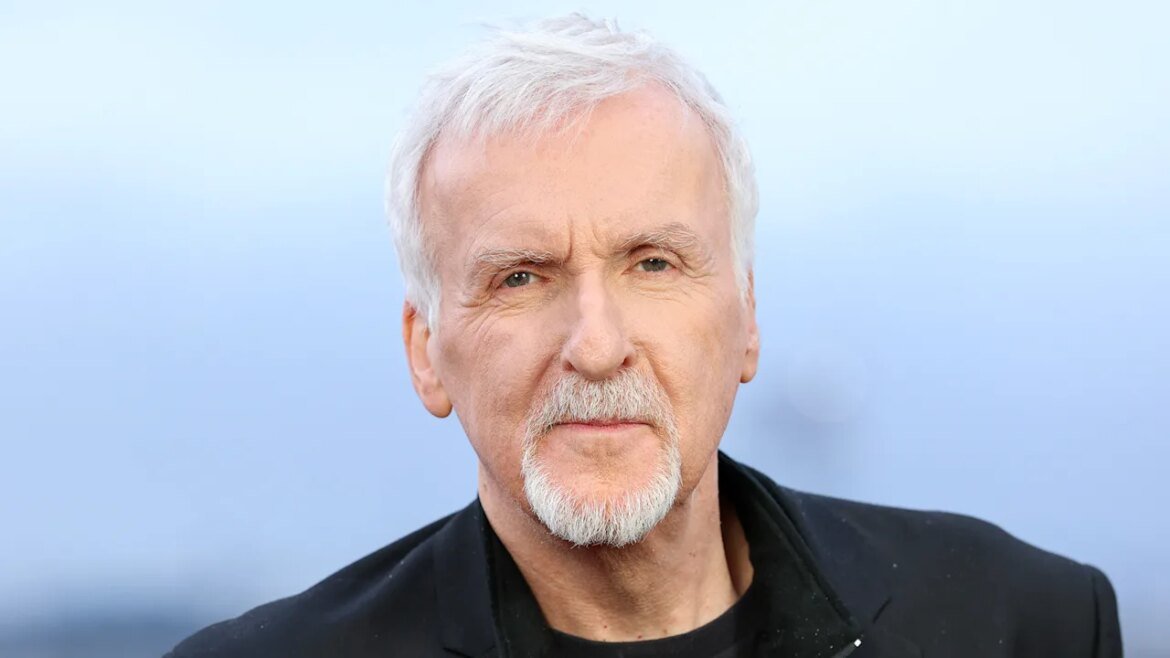

The proposed merger has sparked heated debate in Hollywood about the future of the cinema industry, and now, one of the most successful filmmakers in the world, James Cameron, has entered the fray.

‘Titanic’ director calls proposed merger ‘disastrous’

Many in Hollywood have not publicly spoken out against the proposed Netflix-Warner Bros. merger, fearing it could hurt their future employment prospects should it go through.

However, as one of the most successful and profitable filmmakers of all time, James Cameron doesn’t have to worry about any potential blacklisting.

On February 10, Cameron sent a letter to Republican Senator Mike Lee of Utah, who is chairman of the U.S. Senate Judiciary Subcommittee on Antitrust, Competition Policy, and Consumer Rights, and thus has significant sway over mergers the size of the one the proposed by Netflix.

In the letter, which was first reported by CNBC, the Avatar director did not mince words, saying “the proposed sale of Warner Brothers Discovery to Netflix will be disastrous for the theatrical motion picture business that I have dedicated my life’s work to.”

Cameron’s three main arguments against the megamerger

Cameron’s letter is comprehensive in detailing his opposition to a Netflix-Warner Bros. merger, but most of his points center around three main arguments.

First, Cameron says that if the Netflix-WB deal goes through, it will significantly harm the cinema industry.

“The business model of Netflix is directly at odds with the theatrical film production and exhibition business, which employs hundreds of thousands of Americans,” he points out. He noted that Netflix co-CEO Ted Sarandos has in the past called cinemas “an outdated concept.”

Cameron argues that if Netflix acquires Warner Bros. and, as a result, pushes more of WB’s films to streaming instead of a theatrical release, that will result in movie theaters having fewer films to show, which will not only hurt theater chains but also their employees and thus local communities.

Cameron notes that while Netflix has committed to maintaining a theatrical window for releases for 17 days, that timeframe “is ridiculously short” compared to historic norms.

Second, Cameron says the merger would likely result in fewer motion pictures being made, which would dramatically impact those who work in the film industry, from PAs to visual effects (VFX) artists to caterers.

For instance, on a major film like Avatar, Cameron said that he frequently employs 3,000 people for up to four years. These types of job-creating big-budget films are “highly dependent on a healthy exhibition community.”

“If such films are no longer green-lit because the market contracts further, which the Netflix acquisition of Warner Brothers will certainly accelerate, then many jobs will be lost,” Cameron wrote. “Theaters will close. Fewer films will be made. Service providers such as VFX companies will go out of business. The job losses will spiral.”

Finally, the Aliens director contends that the Netflix-WB deal would hurt America’s soft power and cultural impact across the globe.

“At a time when the US trade deficit is a major concern, one of America’s largest export sectors will be negatively impacted,” Cameron wrote. “Which is to say nothing of the cost to our greatest cultural export: movies.“

“The US may no longer lead in auto or steel manufacturing, but it is still the world leader in movies,” he added. “That will change for the worse.”

Fast Company has reached out to Netflix and Warner Bros. Discovery for comment.

As industry awaits outcome, Netflix stock continues to sink

While Cameron’s letter opposing the Netflix-WB merger likely gives a lot of weight to those who share his arguments, the outcome of the proposed merger is still far from certain—not least of which because Netflix isn’t the only one interested in acquiring Warner Bros.

Paramount Skydance has launched a hostile bid for Warner Bros. that would also include Discovery Global. Any final agreement would of course need to be approved by regulators.

Yet one thing is clear: Since the proposed Netflix-WB merger was announced in December, Netflix’s stock price (Nasdaq: NFLX) has taken a beating.

On December 5, the day the deal was announced, Netflix stock closed at just above $100 per share. As of market close yesterday, NFLX shares were trading at $77. That’s a 23% drop.

On the other hand, shares of Warner Bros. Discovery, Inc. (Nasdaq: WBD) have leapt in the same timeframe.

The day before the proposed merger was announced, WBD shares were trading at around $24.55. As of yesterday’s close, those shares are sitting at $28.53, a jump of more than 16%.